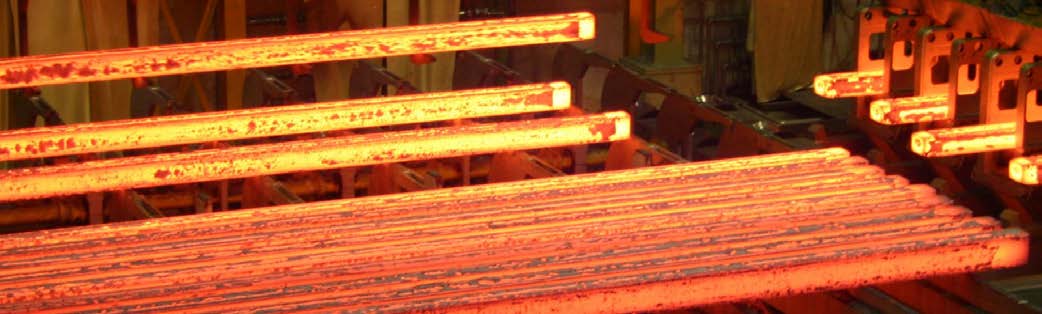

Metallurgical plants in Bulgaria, Hungary, Moldova, and Poland.

Steel consumption is a litmus test of the economy. After a good 2021, 2022 was an unfavorable year for steel distribution in Eastern Europe.

In Poland, for example, demand and prices for steel products have been declining since about the middle of last year. This is the result of turbulence in the economy caused by the war in Ukraine: rising energy prices, inflation, and postponement of investment decisions until better times. This is exacerbated by the lack of funds under the National Reconstruction Plan. As a result, apparent steel consumption fell from 15.3 million tons in 2021 to 13.3 million tons in 2022, 15 percent.

Since last July, the level of stocks at the distributors is at a constant, rather low level. There is no tendency for their recovery. For the first time in many years, apparent steel consumption fell below 1 million tons in July, and in December it was only 680,000 tons, and in January 2023 it was down more than 30 percent. The demand problems are due to declining orders in industries such as housing, infrastructure construction, and machinery. It is recovering only in the automotive sector.

The European steel industry is increasingly being supplanted by imports from third countries, i.e., from outside the EU. Since 2016, Europe has become a net importer of steel. Year after year, imports are increasing. In just a decade, the EU lost 26 million tons of production capacity, of which Poland lost 2.6 million tons. Polish steel products account for about 20 percent of the market, the rest being imports and imports from other EU countries. From 2016 to 2022, Poland’s crude steel production decreased by 1.6 million tons.

Exporters make money from this – and from outside the EU, unencumbered by the Emissions Trading System (ETS) and other rules. In 2021, Russia, Belarus, and Ukraine were among the main exporters from the group of so-called third countries. In 2022 – after sanctions were imposed – imports to Poland were developed by such faraway countries as Indonesia (357 percent growth in the second half of 2022), Japan (+422 percent), and Australia (+138 percent).

In 2022 more than 11 million tons of imported products were used in Poland, and only 2 million tons were produced locally. This is a prerequisite for increasing production capacity in Poland and restoring the state’s influence in such a strategic area as steel production. Węglokoks is preparing to build a new steel plant in Ruda Śląska. It will be a steel smelting plant using electricity. The electricity will come from renewable energy sources, and the steel will be environmentally friendly.

The review looks at the steel industry in several Eastern European countries: Bulgaria, Hungary, Moldova, and Poland.